Historically, It has been hard to disrupt a consumer brand. Many of the leading consumer brands (either individual or a group) – Coca Cola, L’Oreal, Unilever, P&G, Colgate, Gucci, Nestle, etc – have been around for about a century. Over the last decade, however, many emerging Direct-To-Consumer (DTC) brands have challenged the incumbents and taken away their market share in the US E.g. Dollar Shave Club, Caspers, Glossier, Bonobos, Allbirds.

As the number of challenger brands is increasing, even early mover DTC brands are finding it hard to differentiate and grow continuously. Only a handful of brands have been able to break out and even fewer have been able to justify their valuations in public markets. E.g., Caspers – the poster boy of DTC brands – is trading at a $270M market cap on NYSE, a far cry from it’s $1B+ market cap in private markets.

As India is going through a similar surge of DTC brands, we must be mindful of what happened in the US? Why is it difficult to differentiate? And how can one create long term sustainable moats while building a consumer brand business of lasting value?

Let’s start with the basics – The Internet fundamentally changed the brands business and democratized it in the following 3 areas:

1. Giving access to everyone to setup online shops at very low cost

Unlike offline shops that have limited shelf space, online shops have infinite space. A seller today can set up an online shop with minimal investment within a couple of hours without even talking to a human. There is no need to convince a distributor or retailer to keep products.

2. Flipping the marketing cost structure from a fixed cost model to a variable cost model

In the offline world the only sure shot way to build a brand is through mass media – newspaper ads, celebrity endorsements, TV commercials, etc. It is hard for small brands to effectively compete in this medium. With the advent of digital, you can start performance marketing with a small budget.

3. Shifting the high fixed cost distribution model to a variable cost digitally enabled fulfilment

In the offline world, a brand needs to partner with distributors to take their products to retail shops. Distributors work with large volumes as their margins are low, requiring brands to invest significantly in inventory and working capital. By selling directly to consumers, DTC brands no longer need to partner with distributors and retailers.

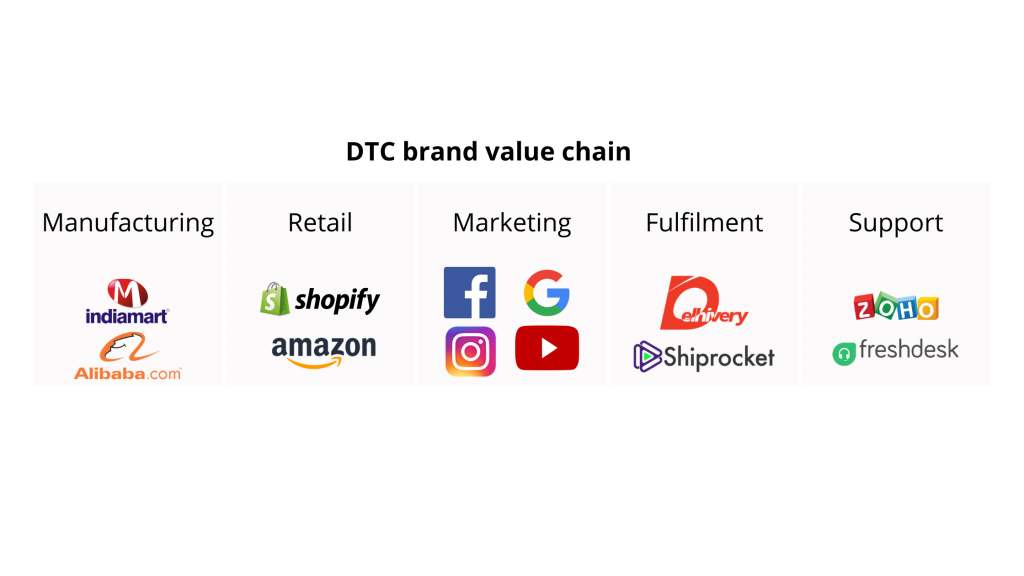

Many platforms have come up to enable new brands to compete at a level playing field even at a smaller scale. For example, Shopify enables everyone to set up an online store, Amazon enables brands to list products without even having an online store. FB / Google ad platforms let anyone run ads with a smaller budget while Instagram lets you set up a brand page to connect directly with the audience. Platforms like Dash101, Loadshare, ShipRocket, Delhivery and Pickrr provide you with plug and play supply chain solutions. Essentially, to start a DTC brand, you don’t need to know anything other than how to stitch a few pieces of software together.

Today, if I were to start a protein bar company, let’s call it ‘My Protein’, here’s what I would do. I would have a hypothesis on what consumers will like, let’s say it is “All Natural” protein bars. Next, I will find a contract manufacturer and work together to create a bar with known natural ingredients and get it manufactured with ‘My Protein’ labels on it. Meanwhile, I will set up a store on Shopify and integrate it with payment gateways like RazorPay. Once the product arrives via Delhivery, I will drive customers to my site by buying ads on Facebook, Google, and Instagram, either myself or by hiring a marketing agency. Once I start receiving orders, I can deliver directly to customers using ShipRocket and answer customer questions on Freshdesk, if required.

Fast forward a couple of years – I launched successfully, used that success to raise funds, and used that money to build a team and acquire a lot of customers. I sold a lot of protein bars, and proved that customers do in fact like natural, well-branded protein bars with clean ingredients, delivered directly to their doorstep.

Attracted by my success, ‘Your Protein’ – another protein bar startup – launched their own brand using the same marketing and supply chain tools that I did, and then ‘Our Protein’ and ‘Indian Protein’ followed them with the same playbook. Each of them copied my products & ingredients, stole my packaging, cloned my website pixel-for-pixel, and even priced their products exactly the same as mine.

All of a sudden, my potential customers have four choices. We’ve all built the same value chain, and we can all move just as quickly. I add new flavours, they add new flavours. I drop my prices, they drop their prices. I bid high on good keywords, they bid higher on the same keywords. To add to my misery, an existing offline brand built its own websites and started selling online as well.

Of course, not all companies do it this way. Many do their own product R&D, set up their own logistics, lease their own warehouses, build a distinguished brand positioning and acquire customers in novel ways. Some may build their own tech stack to make sure that their companies’ unique needs are met.

But the fact that competitors can easily launch a DTC product means that any one brand’s strategic position, and ability to generate profits over the long-term, is weakened. There are 175 online mattress brands in the US alone that took away Casper’s market share. Other categories are equally crowded if not more.

DTC landscape in the US:

Over the next few years, there is a likelihood that more brands will win – but they will reach a smaller scale due to increased competition and lack of differentiation.

If every brand has access to same tools, what can be the sustainable long-term moat?

The Brand itself!

Yes, as cliched as it may sound, the strongest moat a CPG company can build is the brand itself. It is hard to compete and win against a sticky brand.

Let’s take a homegrown example:

In 1993, Coca Cola bought ThumsUp, and shelved it to promote their own brand – Coke. ThumsUp was a very strong brand in India. Even though the product was off retail shelves, the brand continued to exist in the consumer’s mind. Consumers kept looking for ThumsUp, and Coca Cola had to relaunch the brand in 1997 to save their reducing market share. The ThumsUp brand was so strong that even after the absence of 3 years, it immediately became the market leader and continues to be so till date.

What is a brand?

Brand is nothing but a unique concept in the mind of the prospect. It is not what the company markets or what they put on the labels; but it is what the consumer perceives them as. There are 3 key elements to build a strong brand:

- Unique Positioning: Identifying the unique concept that resonates with a consumer segment

- Differentiated product: Developing differentiated products linked to the concept, that delivers underserved value to the chosen consumer segment

- Engaging communication: Consistent relatable communication around the positioning

In case of ThumsUp:

- The unique positioning is of strong and adventurous brand, targeting Indian youth

- The product is spicier and stronger with extra fizz. Different then other sweetened cola products, adapted for Indian taste and linked to the adventurous positioning

- Consistent communication with the tagline “Taste the Thunder” and adventurous marketing ads with high recall

ThumsUp is an outlier though. It is one of the strongest brands ever created in India. Most brand positioning is ‘me too’ with undifferentiated products and no-recall value of advertisements. Supermarkets are flooded with thousands of products, how many you remember? You see hundreds of advertisements every day, how many do you recall? Pick any category, chances are there that you only remember top 2-3 brands in that category while there exists hundreds (and sometimes thousands) of them.

It is hard to build a brand. It is hard to predict trends in advance, it is hard to understand the unmet consumer need and it is hard to engage consumers with your brand concept. Sure one can speak to the consumers and do surveys, but it has its own limitations: limited sample size, often not true representation of the entire market, answers are limited to the scope of the questions asked and often the responses are either incorrect or non-conclusive. Even incumbents, with all the resources, intelligence and marketing money at their disposal, have 80%+ failure rates in building new successful brands.

So, what competitive edge can one have to consistently build strong sticky brands?

Data and technology!

In the offline world it is nearly impossible to get enough data. Brands are starved for data and whatever they are currently able to collect – through focussed group studies, market research surveys, consumer interviews – is not enough to make critical decisions. Also, that data rarely gives you any competitive edge because everyone has access to the same data.

In the digital world, however, a large amount of public and proprietary consumer data is available. You cannot operate a consumer brand in the stealth mode. Product details, ratings, reviews, packaging designs, competitive products, pricing, consumer sentiments, comments on social media pages – all that data is out there. That data coupled with the company’s own proprietary data of consumer behaviour, purchase frequency, repeat % etc. has the capability to deliver deep consumer insights, if captured and studied properly. Emerging brands can innovate to build a sticky brand by leveraging data and technology in the following areas:

1. Effective brand positioning by picking upcoming consumer trends

Understanding consumer’s emotional needs are important to build a deep connection with the brand. New age consumers leave digital footprints on platforms like Google/FB/Insta/YT/Amazon/Specific Interest Groups, and today’s technology is capable of capturing shifts in consumers’ motivation, sentiments and values in near real-time. Technology can further help in separating signals from noise and achieve a higher success rate in positioning a brand that resonates with consumers.

For example, over the past few years there has been a gradual yet notable shift in consumer’s awareness and perspective towards the environment. Global studies show that consumers end up paying 30% brand premium if they are under the impression that the brand is making a positive impact on the world. Yet, very few brands position themselves as being environment friendly. Data and technology could have bubbled this opportunity as a potential white space to create a brand.

2. Differentiated product innovation by identifying unmet needs

Traditionally, change/innovation in consumer brands has been slow. A/B testing of products is difficult in CPG, because unlike tech companies, the products are atoms and not bits. Most incumbent brands are surviving without innovation. They rely on their brand name and distribution with the same product for decades. As a result there is a huge opportunity in many categories to build a differentiated product that fulfils new consumer needs.

This is where data comes in – to help new product development teams identify the right direction to innovate quickly and effectively. The subject knowledge coupled with the vast streams of publicly available data can be useful for uncovering new customer needs, and identifying category specific thematic trends. For instance, in the packaged food category, it is a huge advantage for a health food brand to pick up the Keto trend a few years in advance. The R&D teams can spend their time and resources to develop and test new keto products, like Keto bars, much ahead of its competitors.

3. Personalized customer engagement

With so many brands and products available in the market, with each of them having their own little differentiation, targeting the right customer with relevant messaging and content is of utmost importance. Traditional brands use mass media marketing for reachout and there is no way to personalize the messaging. Tech enabled new age companies could leverage data and technology to identify customer profile, behaviour, likings and needs. A set of business rules and machine learning models can then be used to personalize interfaces, content, offers and experiences for customers. This will allow brands to significantly improve customer engagement, eventually leading to higher conversion and customer satisfaction.

All this however, is easier said than done. Pulling that unstructured data from different sources, cleaning it, normalizing it, matching it and then making sense of it, is really challenging. Using deep tech over unstructured data is not a core competency of existing large CPG brands. Most companies outsource their IT work or at best have a small team of engineers. So, even if incumbents are provided with much richer data than they have today, they are not equipped to use it. This opens a window of opportunity for emerging brands to leverage data and offer better products and experience to consumers, taking significant market share from the incumbents. DTC companies that invest in data and technology right from the get-go would thus be able to create strong differentiated brands and long term sustainable value.

If you are starting a DTC brand startup, would love to catch up and learn more. Please do write to me at naman@stellarisvp.com