Every sector has a few large marketplaces, where brands compete with each other to get the maximum share of the customers’ wallet. For instance, Flipkart/Amazon for e-commerce and Makemytrip/Booking.com for travel. However, in a competitive and cluttered marketplace, one aspect where brands struggle is driving visibility and traffic to their product page. Moreover, even after getting a pie of the traffic, the final sale still depends on the brand’s efficiency to optimize factors that are a part of a customer’s decision-making process such as pricing, reviews, product images, etc.

During my stint at FabHotels, a budget-hotels startup, I realized there are several initiatives that can improve our brand’s performance on different travel marketplaces. Through this blog, I will share some of my experiences and observations that helped us consistently grow our business on both marketplaces and our website/app.

Ensuring product availability and optimizing inventory allocation:

On any marketplace (Flipkart/Swiggy/Makemytrip), the user experience gets severely impacted if a customer chooses a product only to find out that it’s out of stock. Often, this happens because the brand has multiple demand avenues such as its own B2B and B2C channels.

While most brands don’t realize this immediately, the platform typically penalizes them by dropping their rankings on its portal. This lowers brand visibility and negatively affects its performance.

Suppose a marketplace consistently delivers a certain percentage of daily sales. If a one-time B2B order requires the entire available inventory to go out of stock on the said marketplace, the brand must think through the long-term opportunity cost on the marketplace before accepting the large B2B order.

Revenue optimization:

Performance on any marketplace has two aspects: volumes delivered and value/sales generated. In the hospitality domain, this is measured by occupancy (% of rooms occupied from the overall available inventory) and average daily rate (ADR). Maximizing only one of the two can lead to a potential revenue loss. One needs to optimize RevPAR (revenue per available room), the product of ADR and occupancy, to optimize overall revenue.

Introducing surge pricing can enable a brand achieve this objective. Even though airlines and cab aggregators have already been practicing this for sometime now, it is important for a brand to understand and analyze the factors that impact its customer’s pricing-decision while devising the surge pricing algorithm. Alongside the travel segment that will have the highest used case for this, brands in the entertainment industry (example: event booking) and any industry that sells/provides perishable products can intelligently use surge pricing to optimize revenue.

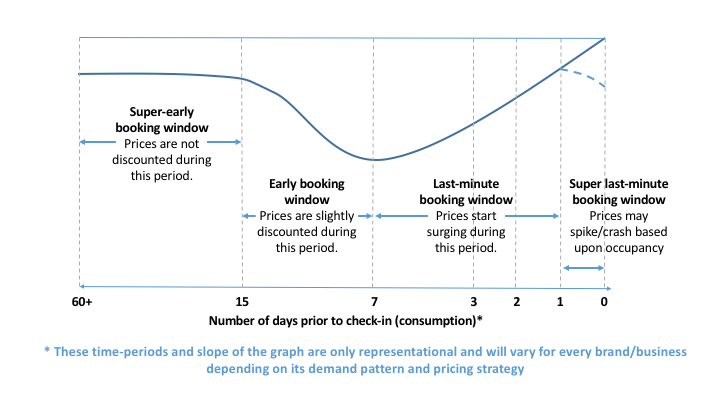

The hospitality industry is an interesting case study to understand the factors that determine the surge pricing algorithm. Traditionally, hotels have only used factors such as occupancy and seasonality to determine pricing variations. However, our research showed how other parameters to play a significant role in a customer’s decision-making process. After conducting experiments and analyzing the data, we were able to put together a revenue curve on the back of our surge pricing algorithm that could help in optimizing the RevPAR:

- Optimising Booking window (BW): Booking Window is the difference between the booking and the consumption date. For optimizing the curve, we realized that pricing for super-early bookings should remain non-discounted, start going down ~2 weeks before consumption, and starts peaking as we approach the consumption date. Last-minute pricing would then depend on occupancy till that point. Understanding a similar BW trend can be relevant for brands in any sector that has perishable inventory such as F&V, events, food tech as they put together their pricing piece.

- Capturing last-minute demand: Today, a lot of customers book at the last-minute (24-36 hours prior to consumption) and willingingly pay a premium for it. At FabHotels, we conducted an experiment, based on location and historical booking patterns, in which a small % of rooms in certain hotels were blocked and then successfully liquidated at the last minute at a premium. The same might be worth experimenting for brands in other segments as well.

- Offering standardized packages/combos: Packages/combos at discounted prices can boost sales of products that individually may not sell well. For example, while most traditional hotels follow a flat pricing irrespective of the stay duration, we figured that offering differential pricing for extended weekend stays at leisure destinations increased occupancy levels on low occupancy days, i.e, Mondays/Tuesdays. Similarly, brands in the food delivery space can club low-selling beverages along with their best-selling dishes to increase the customer’s purchase value.

The power of visual content:

In any e-commerce business, the visual content displayed by a brand is a key factor in a customer’s journey from discovery to transaction. Therefore, it is extremely important for brands to ensure high-quality and sharp images/videos are displayed online. Some key aspects to be considered are:

- Sharing benchmark photos for reference: For instance, if one wants to portray standardized offerings across each of their hotels through the hotel’s images, then Ibis as a yardstick for photoshoot standards can be a helpful input as a part of the brief issued by the brand.

- Image sequencing: While showcasing the best images is important, one should ensure that the image sequencing sketches a story of the product in the customer’s mind. For example, while sequencing a hotel’s images, one should follow the customer’s typical journey rather than directly showing the room. This generally starts with the facade, followed by the reception, and finishes with the rooms and other offerings of the hotel. This would create a mental picture of the product in the mind of the customer, which in turn increases the chances of conversion.

Image 1.0: While both these images are of 4-star hotels in Delhi, the 1st image has the following points which stand-out relative to the 2nd image:

- The complete shot of the room can be seen in the 1st image. As a customer one can form a mental model of the room’s size and amenities.

- The brightness of the 1st image is much richer compared to the 2nd one.

Image 2.0: While both these images are of similarly priced restaurants in Delhi, the 1st image has the certain points which stand-out compared to the 2nd image

- The complete shot of the restaurant can be seen in the 1st image. As a customer I can form a mental model of the restaurant’s ambience.

- The lighting of the 1st image is much richer compared to the 2nd one.

Product description:

Some pointers to be kept in mind while writing the description of any product are as follows:

- Be crisp and concise: People want to read specifics. Rather than using flowery language, try to be crisp and concise. Clearly mention what stands out in your product in order to instill trust. Example of a well-written description of a smartwatch: “Introducing our slimmest smartwatch to date: XXXX is our newest digital display watch. Strapped in black leather, the tech-savvy dial with touchscreen functionality includes customizable faces. Stays charged for up to 1 day with the wireless conductive magnetic charger. From customizable watch faces to interchangeable straps, it’s easy to tell time the smarter way with XXXX.”

- Highlight distinct features: If a brand has multiple products, it should ensure that each of its products has distinct features highlighted separately rather than using a generic description encompassing all products of the brand. This is a common problem seen across several marketplaces.

Reviews:

Given the multiple options a customer has today for any given product across segments, user generated content such as reviews play a crucial role in instilling trust.

- A user review has two aspects, rating and content. As customers today are increasingly investing more time in researching a product before making a purchase, content becomes more impactful than just having a high customer rating. Let’s take the case of beauticians on UrbanClap. Beautician-A has a rating of 4.8 with 20 reviews, but 14 of the reviews have no content. Beautician-B has a rating of 4.5 with 18 reviews, but 14 reviews have detailed content. A customer is much more likely to go for Beautician-B, since the content will enable the customer to form an image of the service. On the other hand, the customer may feel that some of the reviews without content about Beautician-A are fake, and may have a negative impact.

Image 3.0: Even though both reviews are 5-rated, they do not highlight what the customers liked about the product.. While taking a decision, the reader may not trust these ratings.

Image 4.0: Both these reviews are 5-rated, and specifically highlight what the customer liked about the product. As a reader, this is very helpful and enables decision-making.

- In India, there is a high chance a customer will end up sharing his/her dissatisfaction about a product online if (s)he had a sub-par experience. At the same time, (s)he would typically not share feedback if (s)he was satisfied with the product. Thus, it is necessary to reach out to your customers and actively request them to share their feedback. It may be useful to incentivize these customers with discounts, free product trials, loyalty points, etc. for sharing their feedback.

- In case of a travel experience, the brand may reach out in person to its customers during their stay and request them to talk about their experience on the portal from which they made the booking.

- In case of a product, such as skin care lotions, the brand can drop a small note/postcard along with the product requesting customers to share their experiences

- Response to negative reviews:

- In case the brand is at fault, it should acknowledge the feedback and very briefly explain the problem’s root-cause and corrective action taken. This restores the customer’s faith to try the product again. Never should a brand put out a generic response such as – “Thanks for sharing the feedback. We have checked internally and taken the necessary action.” This raises too many questions in the customer’s mind about the brand’s focus towards customer-centricity.

-

- In case the brand finds out that it has been unfairly mentioned by the customer, its response should highlight the case details that resulted in the customer having a sub-par experience. For example: A customer writes about how his/her request for a refund was refused. In case the customer had wrongly requested for a return as per the policies, then the response should be “Dear XXXX, we regret that your request could not be completed. As per the policies that have been mentioned on the product page, this particular product cannot be returned once it has been opened/used. As per the quality check done at your doorstep, the product was in a used condition when it was return request was raised and thus the pickup request had been declined by our executive”.

Even though most of my learnings are from the travel domain, I believe there are parallels that can be drawn in other sectors such as entertainment, food technology, e-commerce, etc. With the evolving ecosystem, there are bound to be more innovative marketing opportunities for brands in the days to come. Would love to chat about this more in detail – I can be reached at kunal@stellarisvp.com.