While I’ve always been more of a board games person, the pandemic and my entry into tech investing pushed me to give mobile games a shot. Admittedly, I’ve spent many a night playing Call of Duty (COD) during the lonely days of COVID and more recently, couldn’t escape catching the Gardenscapes fever as well. While COD would require a group of friends and a commitment of at least 30 minutes for a game, I would find myself playing Gardenscapes while waiting at the dentist’s!

That marked the beginning of my fascination with casual gaming. From finding games distractive & unproductive to now looking at them as large business opportunities, I’ve come a long way. I decided to make a dedicated effort and understand the space better. What follows is a synthesis of insights from lengthy desk research and numerous firsthand interactions with founders, operators, as well as industry experts, accumulated over the past couple of months. For the sake of focus, I’ve limited the scope to casual gaming, not covering mid-core or hard-core gaming studio opportunities.

In this 2-part blog, I aim to delve into two key areas – first, the reasons for excitement surrounding the casual gaming studio opportunity; and second, a primer on building a casual gaming studio from India.

Building a gaming business sure sounds fun, but can it truly become large? That’s a key question founders and investors ponder about before building or investing in one. Well, the answer happens to be strongly in their favour.

Large opportunity size

Hogwarts Legacy, released by Warner Bros., became the highest-grossing video game of 2023, amassing $1B in just one quarter – this is more than any of the Harry Potter movies ever produced!

The gaming industry, a $200B behemoth, has in fact surpassed the combined revenue of the box office, streaming video, and recorded music industries. It’s also growing much faster.

The primary driver of this growth is mobile; and mobile gaming now represents 50%+ of the total gaming market, growing at ~5% YoY.

Of the $100B+ mobile gaming market, casual gaming alone forms 20%. Casual has 3 key genres – Puzzle, Simulation, and Lifestyle. These genres have multiple sub-genres eg. Puzzle category has sub-genres of Match-3 (Candy Crush), Merge (Merge Mansion), Tiles (Triple Tile), Blocks (Blockudoku), Hidden Objects (Hidden Folks), and more.

We believe gaming studios have the potential to become substantially large businesses. Globally, there are:

- 20+ unicorn gaming studios

- 6+ casual-mid core studios with revenue over $1B

- 40+ casual-mid core studios with revenue over $100M

*All the above data is limited by public availability. Actual numbers could be higher

While a lot of markets could be large, growing and attractive to investors, it’s critical that they support viable businesses as well. As it happens, a gaming studio business meets all the key requirements of a healthy business.

Viability of a healthy business

A studio business is the kind investors die for. It exhibits superiorly healthy monetization, unit economics & capital efficiency.

Monetization

Casual games are primarily free-to-play games where monetization happens in 2 ways: ads & in-app purchases (IAPs). Ads:IAP split may vary from 95:5 to 30:70 depending on the life of the game, levels, and types of meta loops.

Core Loop: Series or chain of actions that is repeated over and over as the primary flow of your players experience. E.g. Matching 3 tiles in a Match-3 Candy Crush game.

Meta Loop: Systems and mechanics that wrap the core gameplay. Their intent is to provide long-term goals for players to engage them for a longer period of time. E.g. Gardenscapes (a popular Match-3 game) has the meta-loop of unlocking more story content and renovating player’s home town as the game progresses.

The potential for ad-monetization in casual games is large. According to a Liftoff report, 87% of game installs across all genres are driven by ads shown in casual games.

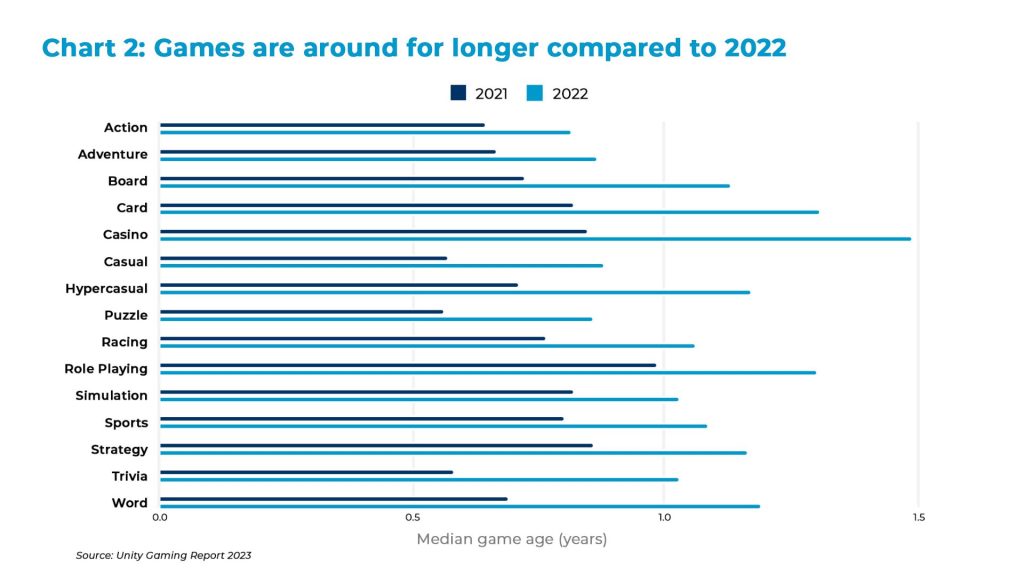

Unlike hypercasual games, casual games also have the benefit of longevity which leads to higher potential for monetization via IAPs as well. In 2022, focus on longevity took centre stage where the lifespan of existing games extended by 33%.

Most Match-3 games are 3-7 years old, and are yet monetizing well. Candy Crush is a classic example (it could be called an outlier though). Even after 12 years of launch, the game is raking over $1B in annual revenue, largely achieved by building multiple games with the same core loop and incremental innovation on top.

In order to keep users engaged and extract most value out of them, it is important to build Meta loops within the game (more on it in Part II of the blog). A thumb rule: If the game starts hitting 10% D30 retention, you can monetize these power users by building hooks.

Game economics

At scale, a good studio should be able to operate at 20-30% EBITDA, with 2 primary cost heads:

a) Live Ops: 10-15 member team required to maintain / upgrade a game. It usually accounts for <20% of topline for a good game

b) User acquisition (UA): At scale, this shouldn’t be more than 50% of revenue in a good case

- Acquisition cost of a user is roughly equal to daily ARPU (avg. revenue per user)

- Over time, organic installs make the business profitable

Since the revenue realization in the initial days is low (entire LTV of a user is not recovered), one needs capital to acquire users. Typically a good game will take 12 months to start showing profitability at a cohort level.

How does changing CPI landscape post ATT & other rules impact economics?

In June 2021, Apple announced its App Tracking Transparency (ATT) update. Since then developers could only use IDFA, Apple’s mobile ad ID, for ad targeting and measurement based on user permission.

Given that iOS user opt-in rates for gaming apps hover around 35% only, it has made life extremely difficult for app marketers to track behavior and target new users. This has forced them to get creative in how they market and measure their efforts. To adapt, developers have started using multiple new strategies.

Post ATT, the average cost per install (CPI) on iOS has touched $3.8 as of Q4 2022, 88% up from Q1 2021, the last quarter before the rollout of ATT. The CPI on Android remains ~$0.6.

While UA budgets have certainly gone up for studios, the exact impact of ATT on games’ acquisition costs remains unknown. Developers are trying to balance the impact by moving away from performance spends to creative campaigns/ASO (App Store Optimisation) driven approaches. Our primary calls suggest that initial months of scaling up a game require 50-70% spend on marketing, but this keeps coming down as word of mouth spreads over time.

Capital efficiency

Return per employee is best in class for the casual gaming industry. It takes a team of 5-7 members with $200-300K, and about 3-6 months to build a game, and another ~$200K-300K on marketing spends. One should be able to build and test a casual game in roughly ~$500K. Once a game starts working, the business becomes capital efficient..

- 30-member studio runs Clash of Clans, a top-grossing strategy title, making $400M+ in annual revenue

- 60-member team runs Pokemon Go, a $6B lifetime revenue title

Indian gaming studios also reflect similar efficiency:

- Playsimple raised just about $5M and scaled up to a $500M+ exit

- Moonfrog was a multi-hundred million dollar outcome, acquired by a larger studio (Stillfront) in 2021. They raised a total of $15M from marquee investors like Tiger & Sequoia and became profitable in 2 years of launch

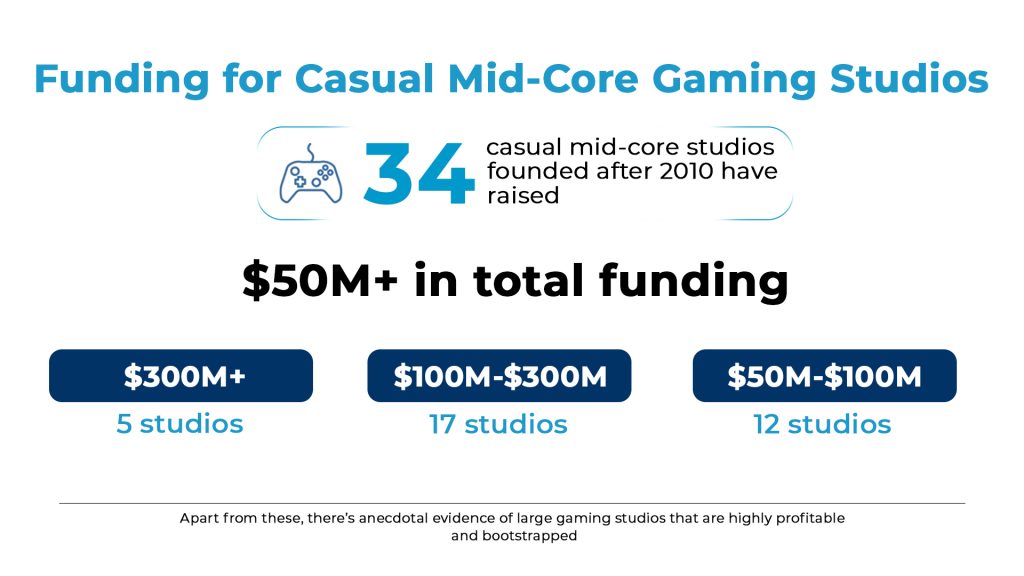

We estimate that it’s possible to achieve an exitable scale with a $10-15M fundraise over the lifespan of the company. Speaking of exits, gaming stands out as one of the few spaces offering lucrative exit opportunities for both founders and investors.

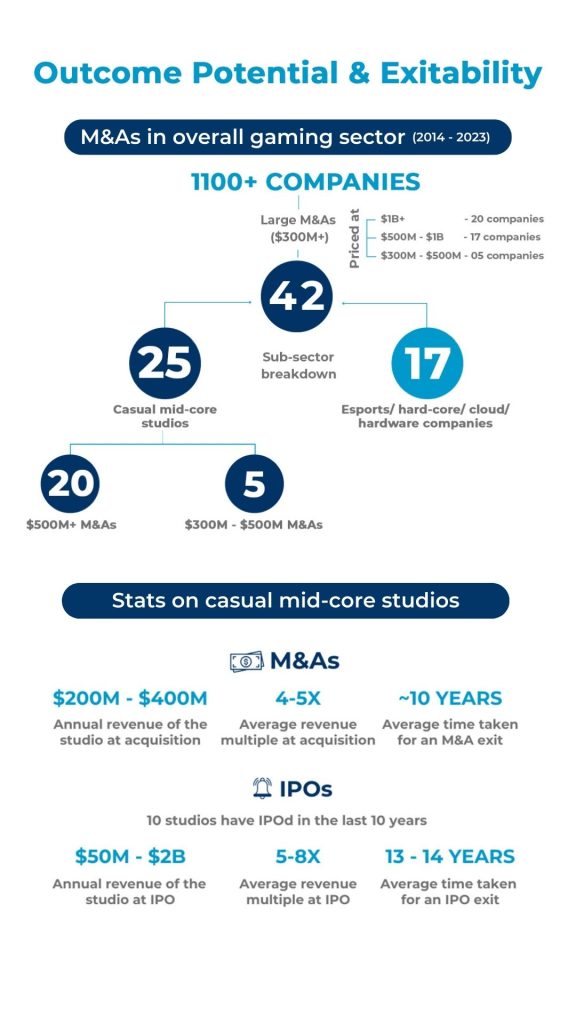

Outcome potential & exitability

Gaming is a highly acquisitive space with large studios frequently acquiring small studios to grow. While M&A is the more likely exit in a studio business, many have gone on to take the IPO route as well. We analyse both in detail below:

Is IP creation required to scale a studio?

While most successes in studios have been built on the back of characters or games that became IPs, e.g. Austin for Playrix, Candy Crush for King, or Angry Birds for Rovio, there’s ample evidence favoring the other side as well.

Dream Games (creator of Royal Match) is doing $500M+ annual revenue with no IP, and so are Supercell’s smaller games with a $100M revenue each. Closer to home, PlaySimple is a $500M+ outcome with no IPs.

We believe that $150M annual revenue is fairly achievable for a studio that manages to build at least 2 successful games (doing $50M+ each) & 2 smaller games.

A large market, equipped with all the essential elements for building a sizable business and offering the potential for a lucrative exit, naturally attracts global interest. Founders from around the world are vying to capture a share of this pie. The question arises: do Indian founders possess any inherent structural advantages when it comes to building a gaming studio from India for the global stage?

India’s structural cost advantage

India stands out for its low-cost & high-quality liveops, an integral part of studio development. Zynga India, in fact, got created because of that huge cost arbitrage. This is the same cost advantage that led to game development moving out of the US to cost-effective & talent-rich countries like Turkey, Finland, Sweden, UK etc.

While India today has earned recognition for its high quality engineering & ops talent, we’re highly confident that, with time, we would develop game design & user acquisition expertise as well to lead and dominate this space.

Our conviction in India’s potential is unwavering, particularly for entrepreneurs seeking to unlock value in the massive opportunity of casual gaming. In Part II, we’ve attempted to outline a primer, offering insights for entrepreneurs aspiring to harness this opportunity and build a casual gaming studio from India. Explore the primer here.

If you’re building in gaming, we welcome you to speak to us. Please reach out at rupali@stellarisvp.com.

Key Takeaways

Casual mobile gaming is a $100B+ market, growing ~5% YoY. There’s ample evidence of gaming studios becoming multi-hundred million-dollar businesses and attracting funding from marquee investors.

Good gaming studios demonstrate three characteristics:

- Superior monetization potential via ads & in-app purchases (IAPs), especially with the longevity of casual games continuously improving over time

- Healthy unit economics with 20-30% EBITDA at scale

- High capital efficiency, often with <10 member teams & <$30M capital required to scale to a sizable outcome

M&A serves as a likely exit strategy, with revenue multiples of 4-5x, as gaming is an acquisitive space. IPO is another exit route with revenue multiples of 5-8x.

Finally, India holds a structural advantage with its high-quality, low-cost engineering & liveops talent. Game design & user acquisition muscles still need developing.