Mayank Jain and Rupali Goel exchange their candid thoughts over a WhatsApp conversation…

Rupali: I was booking a cab on Ola this morning and came across their food delivery offering via ONDC integration. I believe this is an early signal of e-commerce operations moving away from a closed-loop system like Flipkart, Amazon, Swiggy, Meesho etc. to an unbundled/ interoperable one. What do you think?

Mayank: Hey Rupali, I saw that too.

I feel ONDC is well intentioned, and carries great promise to empower small sellers. However, for it to realise its potential, we need to understand what the Consumer value proposition is i.e. why should a consumer buy from an ONDC buyer app instead of a closed loop platform. I’ve, thus far, struggled to find a convincing answer to this question.

Rupali: Fair point, Mayank. We could look at the consumer value prop with 2 lenses – one for the Existing-to-eCommerce buyer & second for the New-to-eCommerce buyer. For the former, ONDC unlocks wider choice i.e. discovery of a larger assortment from a whole bunch of new sellers who were previously only selling offline – in value terms, this represents ~93% of overall retail.

Mayank: You make an interesting point Rupali, however over the last decade, e-commerce industry has made significant investments to onboard sellers countrywide which has resulted in millions of sellers transacting online today, and growing MoM. If certain sellers are not onboarded already by them, it’s for a reason, likely an economic one i.e. the revenue potential for this residual supply doesn’t justify the associated costs, i.e. cost of onboarding and servicing post.

Rupali: Yes, Mayank – I concur with the challenge of onboarding sellers at scale. Digitizing storefronts, building online catalogues, inventory management, all make the Offline-to-Online transformation expensive & operationally challenging.

However, I believe there exists a vast pool of sellers (95M+ of 100M MSMEs) who aren’t able to tap online marketplaces for multiple other reasons.

Like not qualifying the stringent requirements (say, around product quality, type of products etc.) set by marketplaces, being outcompeted by larger brands/private labels that can afford to spend large budgets to appear on first page results etc. As ONDC looks to break this very monopolistic nature of marketplaces by being truly open & neutral, we could be surprised by the size of supply that gets mobilised to sell online. Whether seller-apps can achieve this in an economically feasible way is yet to be seen.

On high seller acquisition cost for marketplaces, an open-loop system could be the answer as the cost of acquiring a supplier gets transferred from a single seller app to multiple competing players (say, Ola, Uber, Rapido).

Mayank: Sure, but stringent requirements of marketplaces provide a superior buyer experience by weeding out poor quality sellers. In fact, it’s my concern that democratisation of sellers without quality checks will lead to dilution of buyer experience. So, to that extent, it’s a feature, not a bug.

I also agree with small sellers not having the ad budgets to market themselves, but this has nothing to do with closed loop or open loop. It’s a side effect of having many sellers on a platform which leads to “problem of plenty”. Sellers then need to distinguish themselves from the herd through ads.

Rupali: Surely, marketplace restraints help in meeting the quality expectations of buyers. But I also believe that the benefits of a 10x (if not more) wider assortment could outweigh the drawbacks of having a few low quality sellers onboard.

Mayank: Rupali, you make an interesting point of trading quality for a 10x assortment. I have a philosophical point to make here i.e. online marketplaces need to maintain a threshold level of quality for it to work. It’s unfair, in my view, to expect online to have the same assortment as offline. Online doesn’t provide for physical inspection, touch and feel, product trials – like offline, and thus carries a much higher trust bar than offline, and it’s completely unreasonable to believe that all 100M offline sellers will be online.

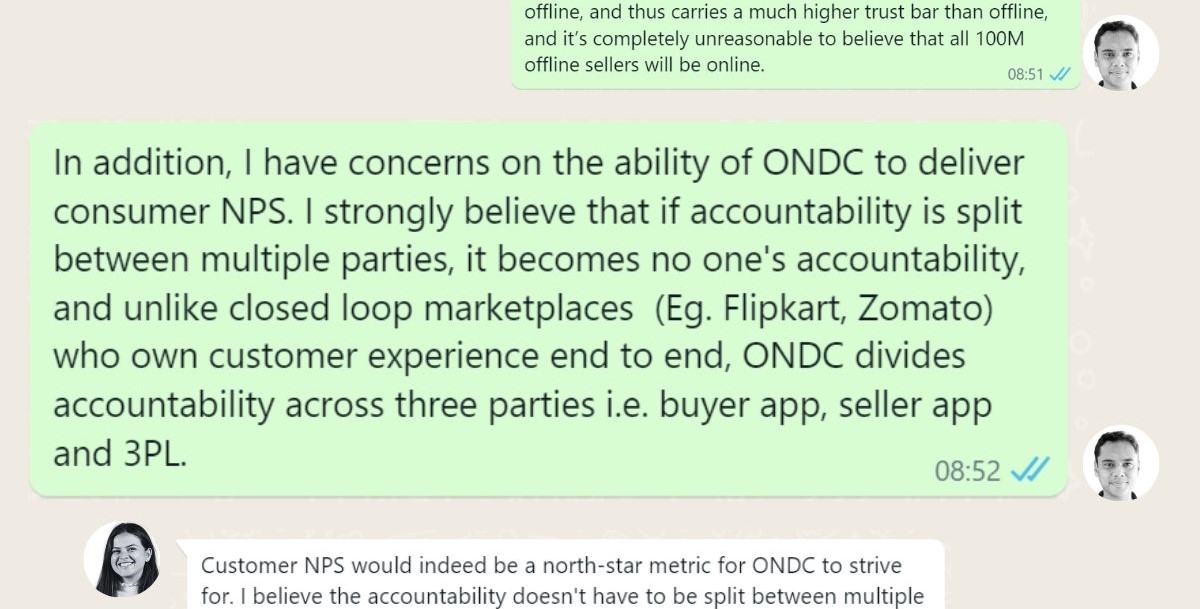

Rupali: Customer NPS would indeed be a north-star metric for ONDC to strive for. I believe the accountability doesn’t have to be split between multiple stakeholders, at least for customers’ eyes. Either the buyer app or another independent party would need to own it for the customer. As in the closed loop system, while a customer attributes service quality to the marketplace, say, Flipkart, Flipkart in the back end works with the logistics partner/seller to solve for the customer concern. Similarly, the customer could rely on say, the buyer app for everything that they rely on a Flipkart for. The backend integrations would have to be made seamless enough to ensure the buyer app is able to transparently establish accountability.

Mayank: Ability to drive buyer experience comes from control, which you sacrifice as a buyer app, or at least so is my understanding i.e. you don’t carry direct control over the seller (which is carried by seller app), nor over 3PL. I don’t understand how you can even match-up with a closed loop provider, let alone being better.

Rupali: Surely control brings reliability, but open markets also bring efficiency. One way to mitigate the control vs. accountability trade off could be to trust that all participants act rationally & seek to optimise their economic self-interests. If they perform poorly, they will be downrated & end up losing business in future. Compared to a closed loop model, poor service could be severely punished by large & hungry competition in an open loop model.

Mayank: You make an interesting point Rupali, and I agree that while sub-optimal, long tail of sellers is indeed a necessary evil for categories that thrive on assortment.

Meesho is a good example of a closed loop platform here, which operates in the unbranded fashion segment, and has hundreds of thousands of transacting sellers, if not millions. They indeed have leveraged economic incentive design to drive good behaviour on their platform from buyers and sellers. Examples include sellers needing to bear return logistics cost in case of evidence of wrong or defective product shipped to the buyer, which incentivises the seller to pay attention while picking, packing and shipping. Or buyers not being eligible for returns till the time they can provide video evidence of either the product being wrong or defective, and not allowing returns on a whim.

While there is evidence of closed loop platforms like Meesho aggregating a large seller base, it’s not clear why an interoperable platform is better than a closed loop one. If the argument is that of unlocking an even wider tail of the seller base, I do have questions on the economic attractiveness of the residual seller base like I said earlier, in addition to my concerns around buyer NPS.

Rupali: Understood your concern. Another value proposition for the existing-to-eCommerce buyer could be a potentially unified experience of shopping multiple categories on one platform (common check out of, say, a suitcase & an airline ticket)

Mayank: I’m also supportive of multiple products being offered to the customer at one place, however, that can be done through a closed loop approach as well, as Flipkart, PayTM, Amazon has shown us. I understand that ONDC makes adding new product categories faster and more scalable, however, buyers will not use it just because all is in one place. Buyers will go where they get the highest NPS.

Rupali: Precisely. Open loop model solves the supply-side challenge of discovering & onboarding supply from scratch for each new category. With that hassle gone, the buyer app can focus on providing superior customer experience for multi-category checkout.

I also see another value prop for the existing-to-eCommerce buyer i.e hyper-local discovery & delivery. I believe ONDC does nearly 1L orders per day. This is across three categories – mobility, grocery, and food, all of which are hyperlocal services.

Mayank: Hmm, first of all, I believe 3P* (third party) model, which is what ONDC is, is not the right model for all categories. While for food, it is indeed the right model, for grocery and mobility it’s my belief that 1P* and 2P* are the right models respectively.

Despite that, if I take food as an example, I believe the argument being made here is that ONDC will help buyers access nearby restaurants which are not already on Swiggy, Zomato etc. I’d again argue that this set of restaurants would be small, and are likely not listed because of their poor economic attractiveness.

*1P = You’re either the seller or fully control inventory and shipping

2P = You’re not the seller, but you have substantial influence over them and the end product quality, either by directing significant business to them or by making them work exclusively with you

3P = You work with many sellers with limited control on them and the end product quality

Rupali: Sound logic there, Mayank.

But consider Namma Yatri – they are an early example of success in breaking the duopoly of incumbents and providing high customer satisfaction through reduced cancellations. They didn’t need to onboard exclusive supply and could in fact, leverage hyperlocal supply to deliver auto hailing services in Bangalore. Over time, more such players could emerge that enable small businesses/ gig workers to be onboarded on supply side & deliver services which the current marketplace models don’t permit. A neighbourhood kirana store onboarded as a seller on ONDC could generate online demand, which could be served hyperlocally. Similarly for a plumber, an electrician or other services which today remain economically infeasible to be delivered hyperlocally at scale.

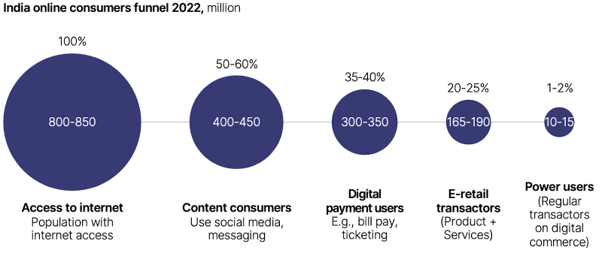

Then there’s a New-to-eCommerce buyer segment which is underserved today, with existing online marketplaces not being able to viably serve them for multiple reasons (unit economics being primary). Again, these represent 75% of the population with internet access – so a large underserved base.

Mayank: In fact, I’d argue that significant investments have been made by the e-commerce industry to bring 150M+ buyers online, and more are getting added each month.

I also understand your point around economics at an order level being a challenge to serve small value orders from remote parts of the country, especially through a doorstep delivery model. I believe innovations on the business model will solve for these challenges, and we’ve seen some from the likes of CityMall and others. However, it’s not clear to me why these innovations should be interoperable rather than closed loop.

Rupali: Yes Mayank, while the 150M number seems large, it represents just 20% of the 800M large internet user base.

As per a McKinsey report, of these 150M, a much smaller number (1% or 10M) is that of power shoppers. By 2030, this base could increase to 500M digitally transacting consumers representing $300B+ worth of digital consumption. To assume that this newly generated value would be captured entirely by incumbents could be slightly naive.

Innovative business models could emerge and command share of the larger pie. In my opinion, interoperability & unbundling could give birth to these new models by reducing time-to-market and time-to-scale for sellers while breaking the monopoly of incumbents.

Click here to access the report

Rupali: Another consumer & seller value proposition that ONDC is expected to deliver is reduced pricing ie. reduced marketplace commission for sellers leading to reduced price for buyers.

Though it’s still unclear to me as to how that would be realised – what’s the fundamental innovation in the supply chain that could lead to reduction in costs? Unbundling indeed would lead to distribution of costs across multiple for-profit participants vs. one monopolistic player but 2 questions remain – 1) whether this unbundling leads to specialisation & efficiencies or chaos & inefficiencies 2) where’s the room to erode monopoly gains given at least presently, the e-commerce marketplaces themselves are struggling to achieve profitability.

Mayank: I agree Rupali, and I myself have similar questions.

To deliver on reduced pricing, the ONDC ecosystem, i.e. buyer app + seller app + 3PL, needs to have a structural cost advantage relative to a closed loop player, which is unclear to me, and I don’t believe government incentives will last. On the contrary, ONDC might be at a disadvantage with for-profit entities like buyer app, seller app and 3PL – requiring profitability separately, unlike closed loop players which don’t have this requirement, and need to be only profitable at an overall level.

Rupali: Hmmm. I’d also love to hear your perspective on the intersection of ONDC and Financial Services opportunity, given you’re our internal fintech guru.

Mayank: Sure, Rupali. I’m excited about the prospect of an interoperable ONDC network for financial services, contingent on their ability to drive adoption within financial institutions like banks, insurers etc.

Financial Services, unlike physical goods, doesn’t suffer from a fragmented small seller base with limited tech and processes; also, being a digital service, and not a physical good to be transported from A to B, it presents a lesser number of failure points. Timing is critical, and unlike physical good commerce where several closed loop e-commerce marketplaces emerged and scaled over the last decade, financial services still doesn’t have robust closed loop providers for lending, B2B payments, insurance to name a few.

If OCEN or ONDC can build pipes for any loan service provider (LSP) or smaller NBFC to connect with a larger NBFC or bank for co-lending or co-origination, that will truly be game changing. Or if B2B fintechs can have interoperable APIs to support vendor payments between any two banks accounts over NEFT, IMPS or RTGS, much like how UPI is for C2C or B2C payments, Or if insurance brokers could have interoperable APIs across all insurers and across policy lifecycle from purchase to endorsement to assignment to claims, these indeed would be game changing.

Rupali: Well, that sounds like an exciting problem for the open network to attack as well. Cool chatting with you on this, Mayank. How the opportunity pans out, only time will tell!