B2B buying is moving online, particularly so since the pandemic. Thanks to the wealth of information available online, buyers today prefer to do their own research independently instead of relying on sellers to educate them – estimates suggest a third of all B2B purchases could happen online by 2025. Consequently, the importance of the marketing function is steadily increasing in B2B companies. As B2B marketing has become more digital, it is more data-driven as well, akin to what happened to B2C marketing as consumer purchases started moving online.

Unlike most B2C journeys, B2B journeys through the marketing funnel can be much more complex. This is driven by three factors.

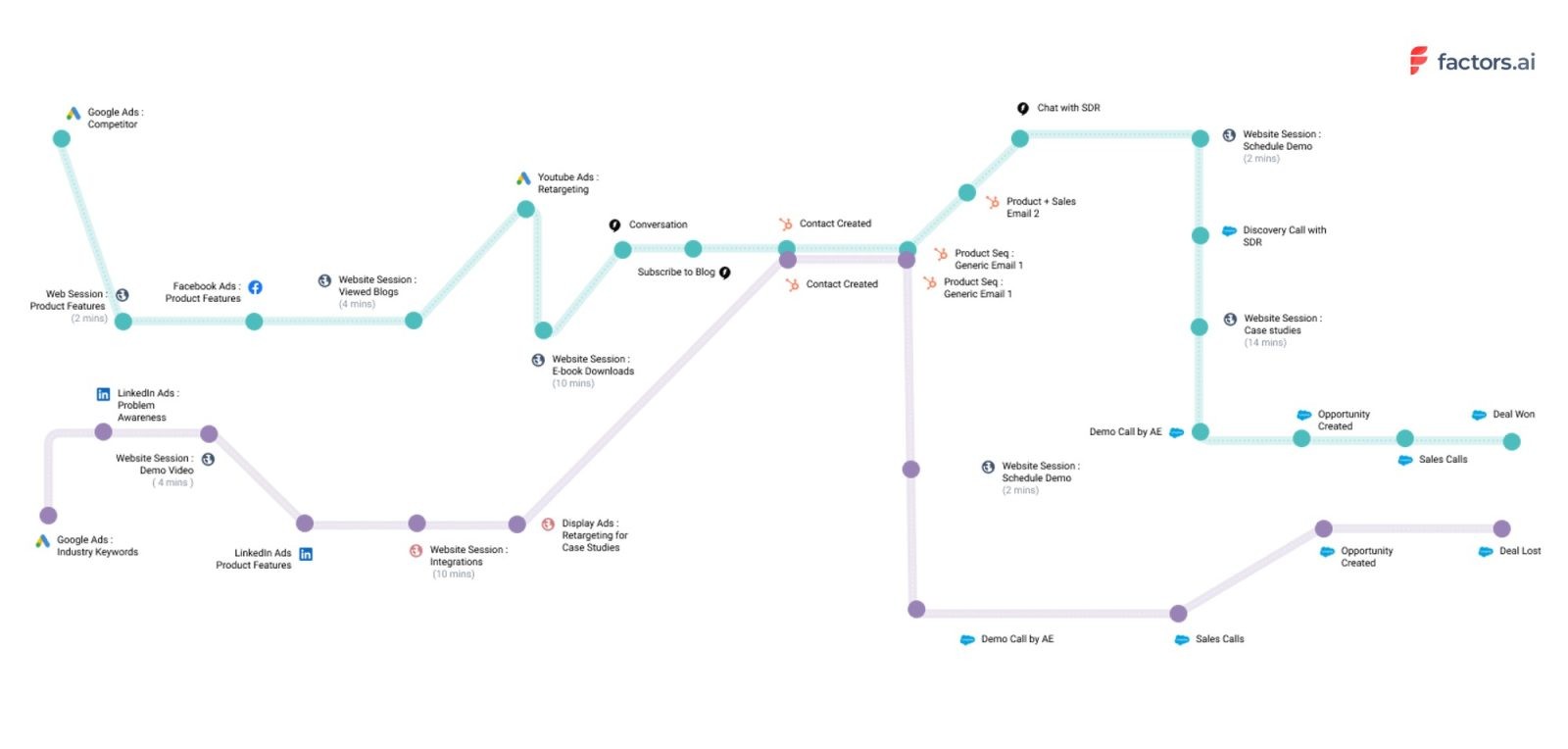

First, there are likely to be a lot more touches with the prospect before they become an opportunity. For example, a prospect may discover you on a twitter ad, read a piece of content, research you on G2, might get a mail from a BDR introducing your product, download a white paper, sign up for a webinar, and eventually have a call with the BDR/ SDR. All this before you reflect as an opportunity in their CRM. Therefore, a marketer needs to analyze journeys and not individual campaigns. Attribution of your marketing dollars to a specific step in the journey is even harder.

Second, B2B opportunities are targeted not at an individual, but to an account. An account will have multiple personas/ people involved with the buying decision. For example, if you are a specialized ATS provider, the account level journey for one of your customers may look like the following – an individual recruiter discovered your product through G2 while trying to solve her own frustration, liked it enough in the free trial to visit your pricing page and read your case studies – before recommending you to the end buyer, the Director of recruitment. Aware of the need to increase efficiencies in the recruitment process, someone in the HR IT team has also read one of your blogs and come to your web site to check out how well the ATS can integrate with their existing HR landscape.

Third, B2B marketing journeys are complex, and it is hard for marketers to identify patterns through querying. For example, there may be a pattern that all prospects that started with a LinkedIn outbound campaign and have less than 1000 employees have a higher conversion rate to an opportunity. However, such patterns are hard for marketers to find today, as they will need to specifically query the system for this hypothesis. With an explosion of permutations of such queries, very often such critical insights are lost.

Figure below illustrates two possible journeys in a classical B2B marketing and sales funnel.

Zoom in on mobile for clear view

Factors is solving this problem for marketers by building a powerful eventstream engine that can collect and analyze millions of events across prospects/ customers, individuals, campaigns and touchpoints. Their product allows marketers to map customer journeys and also test specific hypotheses within these journeys e.g. is a webinar invite helpful for those prospects that are less than 1000 employees and visited the product features page on the website. What makes the product very powerful is its ability to surface insights even without specific hypothesis testing i.e. there might be very interesting patterns that marketers can miss from their data and never ask the questions specifically.

Marketers are also being constantly challenged with the ROI of their campaigns. It is difficult due to the multiple personas and multiple touchpoints across multiple campaigns before a lead becomes a qualified opportunity. Factors also provides a powerful multi-touch attribution platform to B2B marketers to help analyze and prioritize campaign spends.

Factors product has the capability to deliver value within hours (and not days and months), as it starts giving B2B marketers insights about their website visitors by leveraging deanonymization, external data APIs and marrying these to internal data.

We have known Sri, Pravin and Aravind from when they had just started. From Day 1, it was clear to us that this was a team with a rare mix of individual excellence and functional balance – Sri was part of InMobi’s leadership team, where he built a large global business (Wadogo) from the ground up; Pravin brings significant experience in building products that leverage large data sets, and led product for InMobi’s TruFactor business; Aravind had built one business in the past – Chatimity, which he sold to Freshworks – and was amongst the most highly rated engineering leaders at Freshworks. As they focused their efforts squarely on solving for the B2B marketing use case, we found ourselves in the ideal situation for an investor – a world-class team going after an exciting problem statement – and are delighted to have the opportunity to partner with them.

The business has started to grow rapidly, and already serves 100+ customers across the US and other markets. In addition to some highly respected SaaS companies, Factors is seeing traction across a range of B2B businesses e.g. wealth management practices. We are looking forward to working with the team to help create a more predictable go-to-market motion in the near future.

Hear Srikrishna Swaminathan, Co-founder & CEO of Factors.ai on CNBC TV18 Startup Street here